- Start Here

- Buy a Home

- Buyer Start Here

- Step 1 – First Introduction

- Step 2 – Discovery Call

- Step 3 – Lender Call

- Step 4 – Reviewing Your Home Search

- Step 5 – Pre-Qualification

- Step 6 – Touring Homes

- Step 7 – Writing Offers

- Step 8 – Going Under Contract

- Step 9 – Opening Escrow

- Step 10 – Inspection Period

- Step 11 – Appraisal Period

- Step 12 – Move-In / Move-Out Prep

- Step 13 – Final Walk-Through

- Step 14 – Signing Closing Documents

- Step 15 – Receiving Your Keys

- Step 16 – Closed Client Care Program

- Buyer Journey Wrap-Up

- Buyer FAQ

- Rent a Home

- Renter Start Here

- Step 1: Enroll & Get Your Renter Prep Packet

- Step 2: Build Your Renter Profile Package

- Step 3: Meet Your Local Sphere Agent

- Step 4: Choose the Homes You Love

- Step 5: Property Manager Outreach

- Step 6: Schedule Property Tours

- Step 7: Submit Final Applications

- Step 8: Move-In Prep + Utility Support

- Step 9: Move-In Day

- Step 10: Buyer Support + Rent-to-Own Transition

- Renter Journey Wrap-Up

- Renter FAQ

- Sell a Home

- Seller Start Here

- Step 1 – Discovery Call

- Step 2 – Identifying the Ideal Buyer

- Step 3 - Visual Storytelling & Home Prep

- Step 4 - Pricing & Positioning Game Plan

- Step 5 - Creating Pre-Market Buzz

- Step 6 - Digital Campaign Blueprint

- Step 7 - MLS & Listing Launch

- Step 8 - Promoting Across Sphere & Local Networks

- Step 9 - Gathering Buyer Feedback

- Step 10 - Adjusting Strategy if Needed

- Step 11 - Reviewing & Negotiating Offers

- Step 12 - Accepting the Best Offer

- Step 13 - Escrow & Initial Paperwork

- Step 14 - Inspections & Repair Negotiation

- Step 15 - Appraisal & Financing Confidence

- Step 16 - Final Walkthrough & Closing

- Seller Journey Wrap-Up

- Seller FAQ

- Search For Homes

- Home Search

- Search the Newest Listings

- Search by City

- Search Homes by City in Arizona

- Anthem

- Apache Junction

- Avondale

- Buckeye

- Carefree

- Casa Grande

- Cave Creek

- Chandler

- Coolidge

- El Mirage

- Florence

- Fountain Hills

- Gilbert

- Glendale

- Gold Canyon

- Goodyear

- Laveen

- Maricopa

- Mesa

- New River

- Paradise Valley

- Peoria

- Phoenix

- Queen Creek

- San Tan Valley

- Scottsdale

- Sun City

- Sun City West

- Surprise

- Tempe

- Tolleson

- Waddell

- Youngtown

- Search by Lifestyle

- Search for Open Houses This Week

- Featured Sphere Listings

- Search For Communities

- Anthem Community pages

- Apache Junction Community pages

- Avondale Community pages

- Buckeye Community pages

- Carefree Community pages

- Casa Grande Community pages

- Cave Creek Community pages

- Chandler Community pages

- Coolidge Community pages

- El Mirage Community pages

- Florence Community pages

- Fountain Hills Community pages

- Gilbert Community pages

- Glendale Community pages

- Gold Canyon Community pages

- Goodyear Community pages

- Laveen Community pages

- Maricopa Community pages

- Mesa Community pages

- New River Community pages

- Paradise Valley Community pages

- Peoria Community pages

- Phoenix Community pages

- Queen Creek Community pages

- San Tan Valley Community pages

- Scottsdale Community pages

- Sun City West Community pages

- Surprise Community pages

- Tempe Community pages

- Tolleson Community pages

- Waddell Community pages

- Youngtown Community pages

- My Sphere Vault

- Tools & More

- MORE

- Register

- Sign In

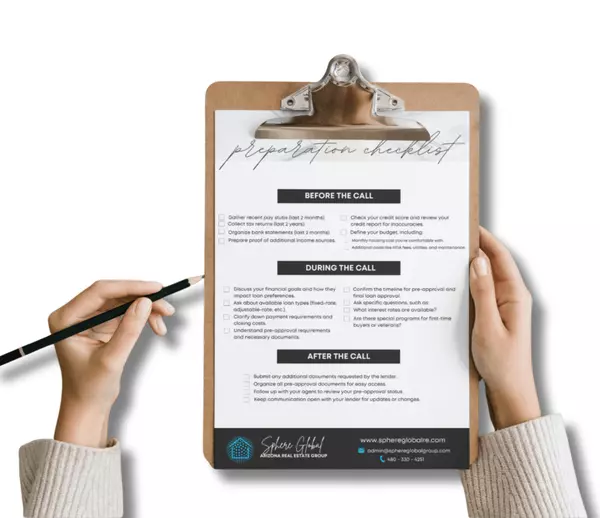

Step 3: Lender Call

This is where things get real — in a good way. A short conversation with a lender helps clarify what you can afford, what’s possible, and what comes next.

What This Call Is — and Isn’t

We’re Not Here to Push Numbers — Just Bring Clarity

Whether you're confident in your credit or still figuring things out, the lender call is designed to help you understand your options — not lock you into anything.

✔️ 15–30 minute intro call

✔️ Learn what you could qualify for

✔️ Ask questions about loans, rates, or credit prep

✔️ No obligation, no application required (unless you're ready)

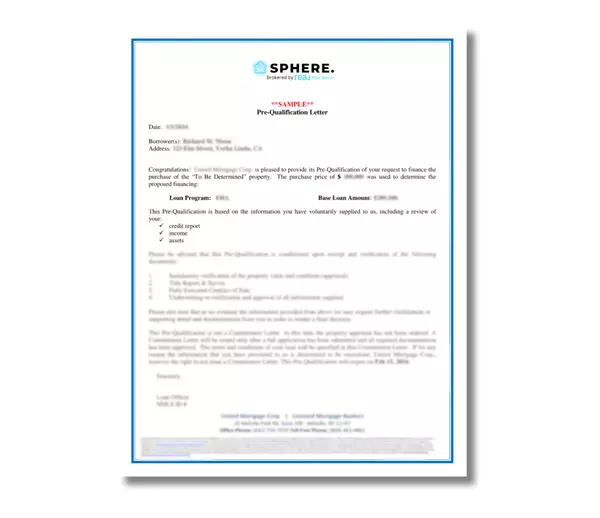

What You’ll Get From It

You’ll Leave With a Clearer Budget — and More Confidence

After the call, you'll know your estimated price range, next steps for pre-approval, and how to adjust your search with confidence.

✔️ Verbal estimate or official pre-qualification

✔️ Guidance on loan types or next steps

✔️ Confidence to search within your real budget

When You're Ready, We’re Connected

Work with your preferred lender — or choose from one of our trusted partners. Either way, we’ll keep the process moving smoothly.